网站公告

more- Diyarbakır E... 25-05-16 08:33

- Diyarbakır S... 25-05-16 08:27

- Kusursuz Mod... 25-05-16 07:43

- Kusursuz Mod... 25-05-16 07:41

Auditing Tax Returns With Ease

FranziskaBanuelos247 2025.05.14 00:49 查看 : 2

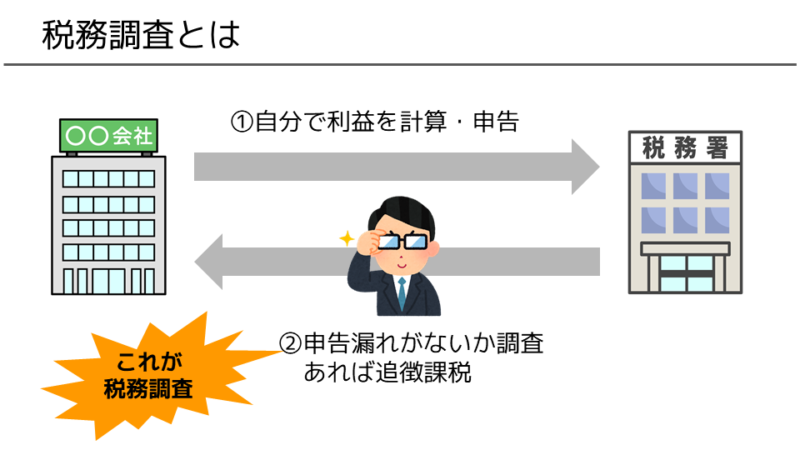

Tax Return Preparation and Audit Defense

As tax year approaches, individuals and businesses usually focus on gathering their financial documents, selecting a tax specialist, and submitting their tax returns on time. However, when the IRS selects your tax return for an audit, it can turn out to be a quite complex and stressful experience. In this article, 税務調査 法人 we'll delve into the importance of tax return preparation and the role of audit defense in navigating a potentially combative situation with the IRS.

A well-structured and accurate tax return serves as a basis for a successful audit procedure. Tax returns typically contain extensive information about an individual's or business's income, expenses, deductions, and credits. Ensuring that all necessary information is captured, and the return is prepared following the US tax code can significantly reduce the likelihood of complications during an audit.

Choosing the right tax preparer plays a substantial role in ensuring that the tax return meets IRS standards and regulations. An experienced tax professional can avoid trivial mistakes and identify all eligible dellusions, thus lowering the risk of triggering an audit. To make an informed decision, it is crucial to select a tax preparer with a certified public accountant (CPA) designation, enrolled agent (EA) certification, or other relevant qualifications.

After submitting the tax return, if it is selected for an review, having an audit defense strategy in place becomes essential. Tax audit defense is a process where a tax professional reviews your tax return, identifies potential areas for audit, and prepares a defense against the potential claims. During an audit, the reviewer will scrutinize the tax return, questioning the accuracy of credits, and potentially claim additional fees.

Tax audit defense involves articulating all necessary information and documentation to support the accuracy of your tax return. In some cases, working with the auditor can result in a negotiated resolution, which can save both parties expense and money. However, when negotiations fail, tax audit defense ensures that all procedural obligations are followed, and the case can proceed to the next stage for a verdict.

Throughout the tax audit process, maintaining open communication and engaging a reputable audit defense attorney is required. They will ensure that all necessary paperwork is completed, deadlines are met, and that the defense assertion maintains regulatory adherence with the IRS.

In conclusion, as with any process involving financial examining, it is critical to be prepared before initiating a tax return. By organizing all necessary documents, selecting the right tax preparer, and having a tax audit defense strategy in place, you can effectively deal with potential complications. Prioritize compliance, stay informed, and seek professional guidance when dealing with tax-related issues to avoid costly blunders that can impact your budget.

?? 0

Copyright © youlimart.com All Rights Reserved.鲁ICP备18045292号-2 鲁公网安备 37021402000770号